Nebraska Deer Hunting Guide: Seasons, Land Access, and Expert Local Tips

The Short Answer: Nebraska’s deer hunting season runs from September through mid-January, with archery season (Sept 1–Dec 31), firearm season (Nov 15–23), and muzzleloader season (Dec 1–31). Hunters can access thousands of acres through the Public Access Atlas, state parks, and Open Fields program, or invest in private recreational land for exclusive hunting opportunities. Lashley Land helps hunters find the perfect property across Nebraska’s best deer habitat.

Nebraska’s Deer Hunting Seasons: Know When to Plan Your Hunt

Planning a successful deer hunt starts with understanding Nebraska’s season structure. The Nebraska Game and Parks Commission manages these dates carefully to balance hunter opportunity with wildlife management across the state’s diverse regions.

2025 Season Dates:

- Archery Season: September 1 – December 31

- October River Antlerless: October 1 – 15

- November Firearm Season: November 15 – 23 (nine consecutive days starting on the Saturday closest to November 13)

- Muzzleloader Season: December 1 – 31

- Late Antlerless Only Firearm: January 1 – 15, 2026

What Hunters Should Know:

- The extended archery and muzzleloader windows give you flexibility to work around busy schedules while targeting peak deer movement periods

- Firearm seasons are shorter but draw heavy participation, especially in areas with strong deer populations

- Antlerless-only seasons play an important role in maintaining healthy herd sizes and habitat balance

- Tag distribution and permits vary by region, so check with the Parks Commission or your local parks office early in the planning process

Local Tip from Lashley Land: Our team often recommends planning early archery hunts near river corridors or agricultural fields, where deer movement peaks before hunting pressure builds. Understanding these patterns across Nebraska’s high plains and river valleys can make the difference between a good season and a great one.

Don’t forget your habitat stamp when purchasing your permit. It supports critical wildlife conservation efforts across the state’s publicly accessible lands.

Why Nebraska Is a Hunter’s Haven

Abundant Wildlife and Access Opportunities

Nebraska’s landscape tells a story of diversity. The state’s geography ranges from Sandhills prairies and Pine Ridge bluffs to eastern river valleys and western high plains. Each region supports healthy populations of whitetail and mule deer.

The best places to hunt aren’t always where you’d expect. Trophy whitetails are increasingly common across Nebraska, with the state regularly producing record-book animals. Mule deer thrive in the western regions, offering a different challenge and hunting experience altogether.

Beyond deer, Nebraska Game and Parks Commission manages seasons for big game species including antelope, elk, and even special permit opportunities for bighorn sheep and mountain lion. Wild turkey hunting in the spring season draws hunters from across the region, while upland game like prairie grouse and small game species including gray fox provide year-round opportunities.

The Public Access Atlas, available through the Parks Commission, identifies thousands of acres of publicly accessible lands managed through programs like Open Fields and Waters Program, giving hunters options beyond private land leases.

Landowner and Private Access Options

While public access provides valuable opportunities, private land offers something different: consistency, less pressure, and the ability to manage habitat specifically for the species you’re pursuing.

Here’s what private recreational property can offer:

- Controlled access means less competition and more predictable deer behavior throughout the hunting season

- The ability to develop food plots, timber edges, and water sources that attract and hold deer year-round

- A place to build blinds, establish trail systems, and create the hunting experience you want

- Long-term investment value that appreciates while providing yearly enjoyment

- Opportunities for nonresident landowners to secure Nebraska hunting rights through property ownership

Owning hunting property gives you something public land can’t: a place that’s truly yours, season after season. From whitetail habitat in eastern river valleys to mule deer country in the Niobrara Unit, having your own ground means no competition and no uncertainty.

Finding the Right Hunting Property in Nebraska

What to Look for in Recreational Land

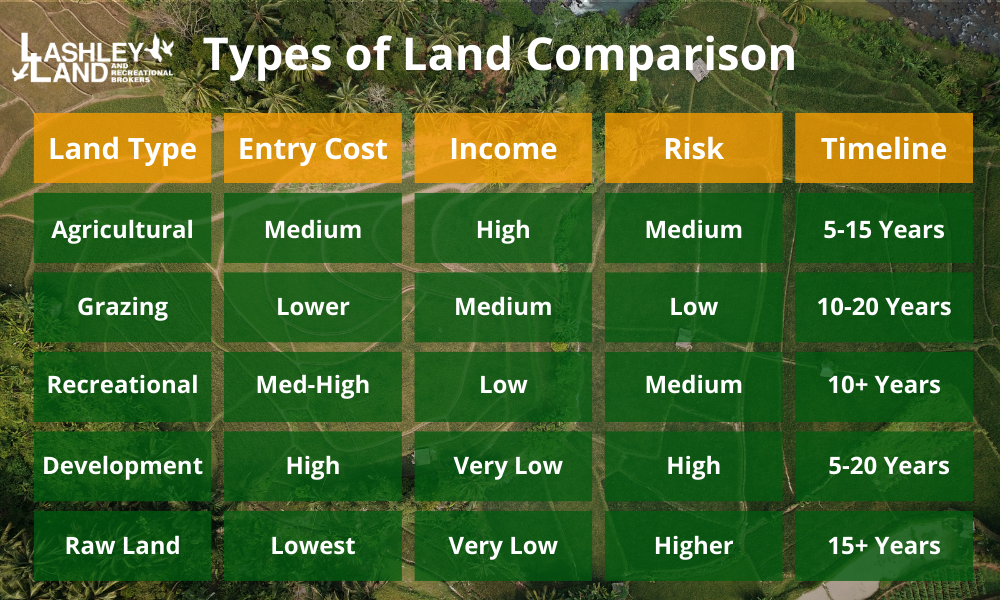

Not all hunting land is created equal. After over 140 years of combined experience in Nebraska land sales, the team at Lashley Land knows what separates average property from exceptional hunting ground.

Key Features to Consider:

- Habitat Variety: The best deer properties include a mix of timber for bedding, cropland or native grasses for feeding, and water access for year-round attraction

- Wildlife Corridors: Natural travel paths between feeding and bedding areas create predictable deer movement and better hunting opportunities

- Accessibility: Year-round road access and proximity to towns make property management and hunting trips more convenient

- Improvement Potential: Look for opportunities to add food plots, shooting houses, trail cameras, and habitat enhancements that increase both deer activity and property value

Understanding harvest limits, bag limits, and possession limits for your target species helps you evaluate whether a property can support your hunting goals season after season. Properties near state park lands or within known deer concentration areas may offer enhanced opportunities during both the auxiliary season and primary hunting periods.

Why Buy Hunting Land Near Nebraska’s Best Deer Habitat?

A Hunting Property That Grows With You

Recreational land in Nebraska’s prime deer country offers more than just a place to hunt this season:

- Build Your Own Hunting Paradise: Develop food plots, create trail systems, establish shooting houses, and manage habitat specifically for the deer you’re targeting

- Multiple Hunting Opportunities: Beyond deer, your property can support wild turkey hunting, waterfowl pursuits, upland game like prairie grouse, and small game hunting throughout the year

- A Place for Tradition: Hunting land becomes a gathering place for family and friends, creating memories and traditions that last for generations

- Smart Investment: Well-managed recreational land with good habitat and access in Nebraska holds strong value as hunting properties become increasingly scarce

Find Your Ideal Hunting Property with Lashley Land

At Lashley Land and Recreational Brokers, we specialize in helping hunters find their perfect piece of Nebraska hunting ground. If you’re searching for river bottom whitetail habitat, high plains mule deer country, or mixed-use land that offers both hunting and income potential, our team brings over 140 years of combined experience to guide you through the process.

We understand what makes hunting land valuable—from wildlife corridors and water access to habitat variety and year-round accessibility. More importantly, we know Nebraska’s regions and can help you find property that matches both your hunting goals and your budget.

Start Your Search Today

Ready to turn your deer hunting dreams into reality? If you’re planning this season’s hunt or looking to secure your own piece of Nebraska’s best deer habitat for years to come, Lashley Land can help you find the right property.

Browse our available hunting and recreational land listings and discover properties across Nebraska’s prime deer country from the Pine Ridge to the river valleys. With Nebraska’s combination of long hunting seasons, thriving deer populations, and accessible land opportunities, your next trophy buck is never far away.

Contact Lashley Land & Recreational Brokers today for trusted, local guidance on finding your perfect Nebraska hunting property.